Despite economic headwinds created by record inflation, rising interest rates, lower consumer spending, slower job growth and growing discussions of a national recession, recently released Q2 market reports distributed by MacKenzie Commercial Real Estate Services and Lee & Associates | Maryland point to continued optimism in the Central Maryland commercial real estate market. Vacancy rates remained stable or slightly declined in the retail and industrial real estate asset classes. Meanwhile, reduced leasing activity and corporate downsizing has created a negative net absorption rate in the commercial office sector in certain submarkets.

The MacKenzie Market Report 2nd Quarter 2022 Local Outlook was compiled in partnership with Anirban Basu, CEO of Sage Policy Group. The report analyses the Greater Baltimore metropolitan market as well as Maryland counties that are part of the of the Washington, D.C. metropolitan market. According to Basu, the national economy weakened in the past several months due to inflation rising 1% in May, the pace of job growth slowing to its one-year low, and mortgage applications reaching their lowest level since 2000. Consumers continue to be impacted by rising food and energy prices, and have finally curtailed their purchases with the sales of retail goods and food services dipping 0.3% in May.

The MacKenzie Market Report 2nd Quarter 2022 Local Outlook was compiled in partnership with Anirban Basu, CEO of Sage Policy Group. The report analyses the Greater Baltimore metropolitan market as well as Maryland counties that are part of the of the Washington, D.C. metropolitan market. According to Basu, the national economy weakened in the past several months due to inflation rising 1% in May, the pace of job growth slowing to its one-year low, and mortgage applications reaching their lowest level since 2000. Consumers continue to be impacted by rising food and energy prices, and have finally curtailed their purchases with the sales of retail goods and food services dipping 0.3% in May.

As has been the case with recent national recessions, the Baltimore-Washington, D.C. region has typically entered downturns later than most markets around the country and emerged sooner. This is due to the presence of the federal government which remains a significant economic driver, combined with a diverse business environment.

Office sector still struggles

The volume and size of commercial office leases in Central Maryland were closer to 2020 figures than those reached in 2021 for second quarter 2022, according to MacKenzie. The Columbia submarket achieved nearly 288,000 square feet of leasing activity, followed by approximately 270,000 square feet of leases signed in the Central Business District of Baltimore City, but the vacancy rate rose in each to 13.8% and 18.2%, respectively. The negative net absorption trend is the result of corporate downsizing or right-sizing and the rise of sublease space which, at 1.7 million square feet of space, resides at an all-time high. Rental rates ticked slightly higher, to offset landlord concession and more expensive tenant improvement packages.

Retail remains resilient

MacKenzie reported a decline in the overall retail vacancy rate in Central Maryland to 6.2%, representing a slight decrease from the 6.3% rate of the previous quarter and the 6.6% rate from Q2 2021. The total market size is more than 115 million square feet of retail space. These numbers were achieved despite the nearly 80,000 square feet of new retail space delivered recently, with activity shifting from fast-casual and sit-down restaurants to categories that include car wash operators, children’s learning centers and national self-storage brands. Optimism abounds in Baltimore City for a possible retail renaissance, centered around MCB Real Estate’s plan to assume control of the iconic Harborplace on the city’s waterfront.

Growth continues in industrial sector

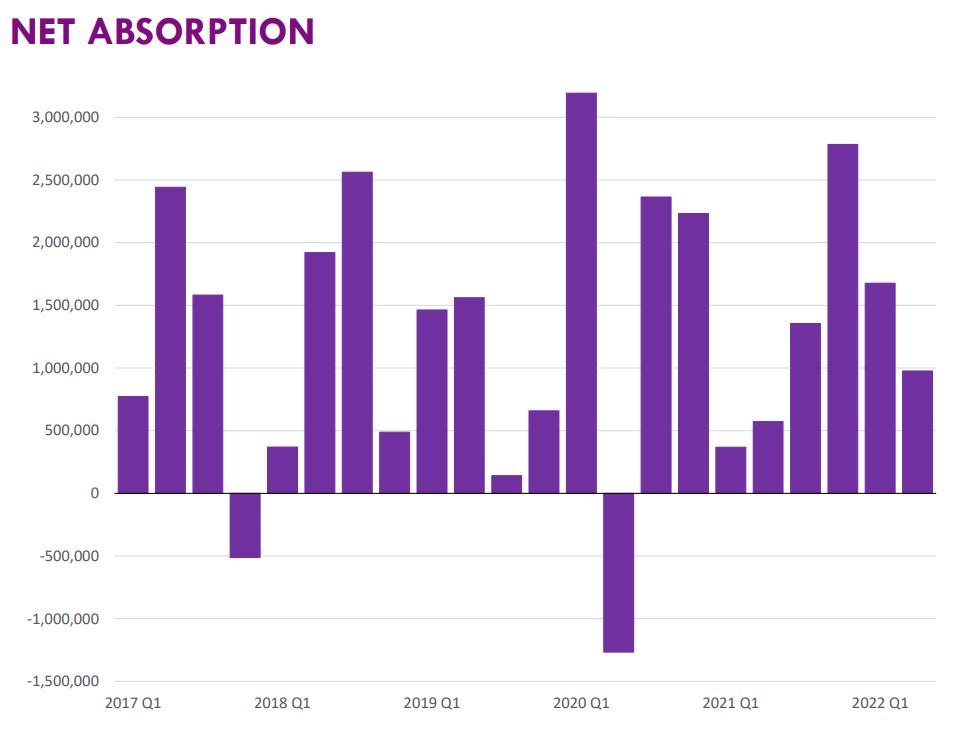

Industrial overview (warehouse) net absorption graph in the MacKenzie Market Report 2nd Quarter 2022 Local Outlook.

The seemingly unstoppable industrial train is showing no signs of a retreat, despite nearly 1.6 million square feet of industrial space delivered during the last quarter, according to Lee & Associates | Maryland. The company analyzed market conditions in Baltimore City and nine Maryland counties – Anne Arundel, Baltimore, Carroll, Cecil, Frederick, Harford, Howard, Prince George’s and Washington.

The cumulative vacancy rate stands at 3.95%, on the strength of approximately 2.7 million square feet of leasing activity, and nearly 15 million square feet of space is currently under construction. The net absorption for Q2, according to Lee & Associates, was nearly 1.8 million square feet of space. Sixty-six sales transactions occurred, totaling more than $516 million in volume. The asking rent increased from $7.28 in Q1 to $7.66 in Q2 and the largest transaction of the quarter was the 598,000 square foot lease signed by Baltimore International Warehouse & Transportation at Aviation Station in Baltimore County.