The industrial real estate market will experience record-high demand in 2021 and 2022, according a new NAIOP study.

“Demand for industrial real estate continues to be strong as the long-term trend toward e-commerce (and away from in-store sales) continues with no end in sight,” the NAIOP Industrial Space Demand Forecast states. “With nearly 100 million new square feet delivered nationally since the beginning of the year, 450 million square feet currently under contract and another 450 million planned, the demand for industrial real estate still outpaces supply.”

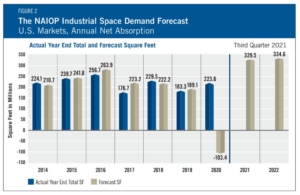

In the midst of the pandemic, demand for industrial space defied expectations in 2020. Forecasters had predicted that net absorption would fall 103.4 million square feet. Instead, net absorption grew by 223.6 million square feet, exceeding 2019’s net absorption of 183.3 million square feet.

The NAIOP Research Foundation now predicts net industrial absorption will reach 329.5 million square feet in 2021 and 334.6 million square feet in 2022.

“Led by coastal port cities, industrial transaction prices per square foot are on the rise, vacancy rates remain low and new leases are being signed at higher rates,” the report states. “A continued surge in imports from retailers restocking depleted inventories has exacerbated the shortage of warehouse space near major logistics hubs, highlighting the need for additional construction… There is continued need for more last-mile industrial space and cold-storage facilities, which supports a premium for properties adjacent to more densely populated areas.”

Those conditions, combined with higher than expected growth in U.S. GDP, are creating a healthy investment climate for industrial projects.

“Strong returns on industrial real estate have continued to attract investment in the sector, contributing to higher transaction prices and additional development,” according to the forecast.