State revenues remained surprisingly strong during the height of the pandemic, but state budget analysts see deep cash shortfalls over the next five years. The depth of those shortfalls will largely hinge on how quickly jobs and income recover under the state’s “official” and “alternate” economic scenarios.

Although lower than pre-pandemic estimates, state revenues in Fiscal Year 2020 exceeded May estimates by $823 million and beat 2019 revenues by 2.4%.

State and local income tax collections overcame a devastated hotel and restaurant sector (where tax revenue dropped 17.4%) to increase by 5.8% compared to 2019. Disparate impacts on retail trade and a new Internet sales tax resulted in a 6.3% retail sector increase. The high-income finance and insurance sector increased by 8.2%.

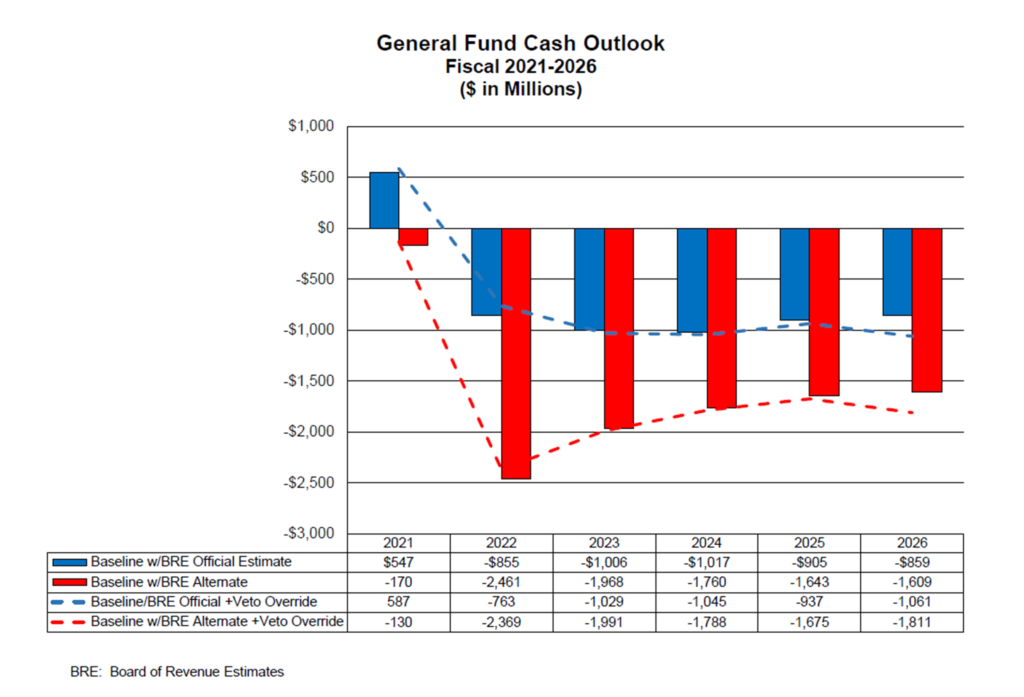

Because state revenues are so dependent on sales and income taxes, how fast employment recovers will have a huge impact on the extent of five-year General Fund cash shortfalls.

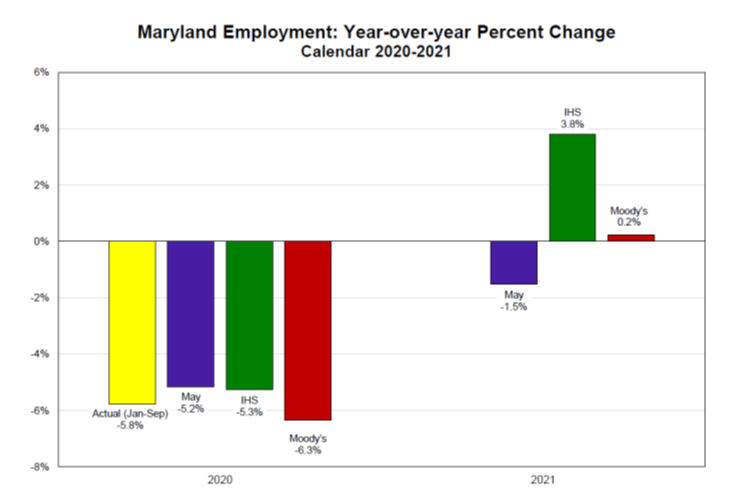

The “official” state data is based on U.S. and Maryland economic forecasts from IHS Markit which show employment rebounding by 3.8% in 2021 (Figure 1). Bars in purple represent the May estimates from the state board of revenue. A more pessimistic, “alternate” economic scenario is based on a Moody’s Analytics’ employment increase of only 0.2%.

The more optimistic IHS scenario would result in a slight increase in General Fund cash in 2021 and a $855 million shortfall between projected spending and 2022 revenues (Figure 2; shown in the blue bars). The slower jobs recovery in the Moody’s scenario indicates a $2.46 billion budget shortfall in 2022 (Figure 2; shown in the red bars).

The Board of Revenue Estimates has scheduled a decision meeting for December 15th to reconcile the current data and adopt an official revenue estimate that will guide decisions during the 2021 General Assembly session.